This past February marks the third anniversary of my first individual stock purchase. Since then, the market has been pretty boring, with record low volatility. There were a few times of drama, like the inverse VIX blow up and the market selloff Q4 2018. By the time stocks were starting to get affordable in these sell offs, the market changed course and ripped higher. Now the market is in a period of turmoil, understandably so with this pandemic crisis. With this apparent bear market, I wanted to provide my thoughts on what’s going on, and document my buys, sells, and performance on this blog.

Before I publish future posts on what stocks I’m analyzing, or how I’m allocating my portfolio, I wanted to give some background on my investing activities. So far, my portfolio has held up decent during this sell off. However, I am massively overhauling my portfolio towards value stocks. This post aims to show my past thought process for my allocation, and the changes I’m making going forward.

Past

My portfolio is currently a hodgepodge of funds and asset classes, but at one point it made sense. The allocation I was aiming for consisted of not just diversifying across a large number of stocks, but diversifying across asset classes. Multiple asset classes can help protect the portfolio through all scenarios, such as a rising or falling stock market, and a rising and falling interest rate environment. The target allocation was to split the portfolio into stocks, emerging markets (EM), commodities, and money market (MM). The rough percentage allocation I was going for is shown in the figure. These positions were spread across a 403(b) (401(k) for public employees), Roth IRA, and taxable brokerage accounts.

The stock portion of the portfolio was primarily focused on buying individual stocks through a Roth IRA and taxable account. My philosophy on stocks firmly falls into the value investing category. The stocks I bought were generally quality, low debt companies that I believed had some sort of competitive advantage. February 2017 was the beginning of my stock picking foray, and lasted until mid 2019 where I wound down my positions to buy a house.

In February of 2019, I started a new job, which provided a 401(k). The default allocation was a target date fund that I assume is mostly in US stocks. Since I was lazy, I didn’t change the allocation, so this stock allocation has steadily increased. While a large chunk of my investments are in the 403(b), this 401(k) will march on to eventually have a more important role in my portfolio.

The next stock allocation was in the form of emerging markets. At the time the S&P 500 appeared overvalued, so I was looking for alternatives. Emerging market indexes were at a lower valuation than US stocks, which was compelling to me. Additionally there is the thesis that EM countries have younger demographics than the US, Europe, China and Japan. This younger population could drive higher GDP growth than the countries with a large aging population. With faster growing economies, these countries have the potential to offer better returns compared to expensive developed markets. While this thesis makes sense, I have become more skeptical, which I may elaborate further in a separate post.

Commodities were another asset class I wanted exposure to for diversification. The thought process for this was that commodity indexes were at historical lows compared to the S&P 500. While it is impossible to value commodities like you can with a business, they appeared cheap. The bullish case for commodities is a rise in inflation. I do not believe excessive 1970’s style inflation is heading our way, but it would be nice to allocate capital to something that should keep up with inflation. Another bull scenario was China’s One Belt One Road initiative, which would be the largest infrastructure project in the world. The demand for raw materials would cause commodities prices to rise. Given the current state of affairs with the world, I’m not quite sure how far One Belt One Road will get.

A specific commodity I wanted to allocate to were gold and silver. Gold is a controversial asset because gold bugs say the financial system is going to collapse with hyperinflation, and the only savior is gold. I don’t know about all that, but gold and silver are attractive to me because they are historically cheap compared to stocks, they keep up with inflation which is nice in a world of low bond yields, and they are a safe haven asset that should provide insurance during a bear market. My precious metal allocation is rather small, and if stocks crash and metals go up, I would sell my stake to buy stocks.

Finally I allocated a rather large portion of my portfolio to money market funds. These are like savings accounts that aim to protect your principal without any risk from equities or bonds. Since stocks were overvalued, I wanted to have a stash of capital that I can rotate into equities during the next recession. While some people oppose the idea of building cash reserves during expensive markets, this allocation cushioned my portfolio during the craziness going on in the markets right now.

My one regret is that maybe I should have allocated to bonds instead. At the time I thought it was pointless to own bonds with yields so low. Now that yields have gone to a crazy 0.5%, the capital gains on the bond allocation would have been very nice. I missed the boat on that trade, but it happens. Bond prices could continue to rally if rates go negative during this recession, or maybe some inflation will show up and put a hurt on bonds. For now, bonds just seem too hard.

The last component to my investing strategy is to apply a tail hedge strategy. The idea is to pay a small premium to hedge against low probability events such as a 20% market drop. This was performed by purchasing SPY put options that were 30% out of the money. If the market sharply fell, the option would greatly increase in price based on the underlying SPY price approaching the strike price. Volatility has a key role in option pricing as well, high volatility drives up the value of the put option.

| 12/31/19 | 3/27/20 | |

| Target Date | 10962.24 | 11316.09 |

| Money Market | 22773.67 | 22779.8 |

| EM | 17675.3 | 13633.62 |

| Commodity | 13833.7 | 10125.48 |

| Precious Metals | 7861 | 8072.6 |

| Total | $73,105.91 | $65,927.59 |

| Contributions | 3177 | |

| Return | -13.80% |

Present

As I mentioned previously, the value stock part of my portfolio was liquidated in 2019. I should have reorganized my portfolio, but I never got around to it. Therefore my portfolio was kind of ugly going into the COVID19 crisis. After calculating my returns from the end of December 2019 to now, my hodgepodge portfolio still held up decently. The table below shows the market value of my portfolio holdings from the end of 2019 to present. My 401k contributions are included for clarity and are factored into the return calculation. At the 401k/403b level, my portfolio has returned -16% YTD.

This performance comparison leaves out the contribution of my tail hedge strategy. As the market began to violently react to the realities of this pandemic, I sold my put options on 2/28/20. In hindsight I was early, but the hedge did its job and I wanted to capture the gains while I could. The cost of the SPY puts were about $600 and the proceeds were $10,148. Year to date I spent $313 on SPY puts, plus I had some left over from 2019.

With this $10,000 windfall, I had the daunting task of finding good opportunities to reinvest in. The turmoil is not causing me stress (so far), but I do feel unprepared since I am lacking a list of companies I’d like to buy at the right price. My modus operandi has been to find quality stocks trading at attractive free cash flow yields. I’m trying to tactfully make purchases since I don’t want to use up all my ammo before the market bottoms out.

The three stocks I’ve bought so far are Capital One (COF), Simon Property Group (SPG), and Emerson Electric (EMR). The table shows my cost basis and current market value. I don’t want to go into my thought process on these stocks right now, I’ll do that in a separate write up. During this volatility, I fully expect a period of trying to catch falling knives. So far, the performance of my new acquisitions are reflecting that. However, my time horizon for these stocks are several years, maybe indefinitely, so I’m not worried about temporary deterioration in business fundamentals or price moves.

| Company | Ticker | Cost Basis | Market Value | Change |

| Capital One Financial | COF | 3,478.75 | 3,041.50 | -12.57% |

| Simon Property Group | SPG | 3,427.00 | 2,675.82 | -21.92% |

| Emerson Electric | EMR | 3,485.00 | 3,874.30 | 11.17% |

Factoring in my retirement accounts, and the reinvestment of my tail hedge, a breakdown of the portfolio is shown in the table. The total is the sum of the portfolio values at the specified dates, while the return takes into account the 401k contributions and cash infusion into the portfolio. In total, my portfolio is down 2% YTD compared to the S&P 500 being down 21%.

| 12/31/19 | 3/27/20 | |

| Target Date | 10962.24 | 11316.09 |

| Money Market | 22773.67 | 22779.8 |

| EM | 17675.3 | 13633.62 |

| Commodity | 13833.7 | 10125.48 |

| Precious Metals | 7861 | 8072.6 |

| SPY Put | 192.5 | 0 |

| Stock | 0 | 9591.62 |

| Cash | 0 | 1976 |

| Total | $73,298.41 | $77,495.21 |

| Contributions | 5677 | |

| Return | -1.9% |

Future

As this pandemic and market turmoil continues, I’m trying to figure out my investing plan. While still maintaining a decent amount of emergency savings, I want to deploy some of my current and future savings into buying value stocks.

One of my first tasks is to reorganize my retirement accounts. The first action I did was to review what value funds are available in my 401(k). Based on the options, I’m going with Bill Nygren’s Oakmark Fund instead of the current target date. As for my 403(b), I’ve been procrastinating on going through the IRA rollover process. Once this is complete, the largest chunk of my portfolio will be able to be invested however I want, instead of the few funds available by the provider. Instead of the multi-asset class portfolio, I’m going to focus this IRA rollover on either individual value picks, or some value ETFs such as ZIG or QVAL.

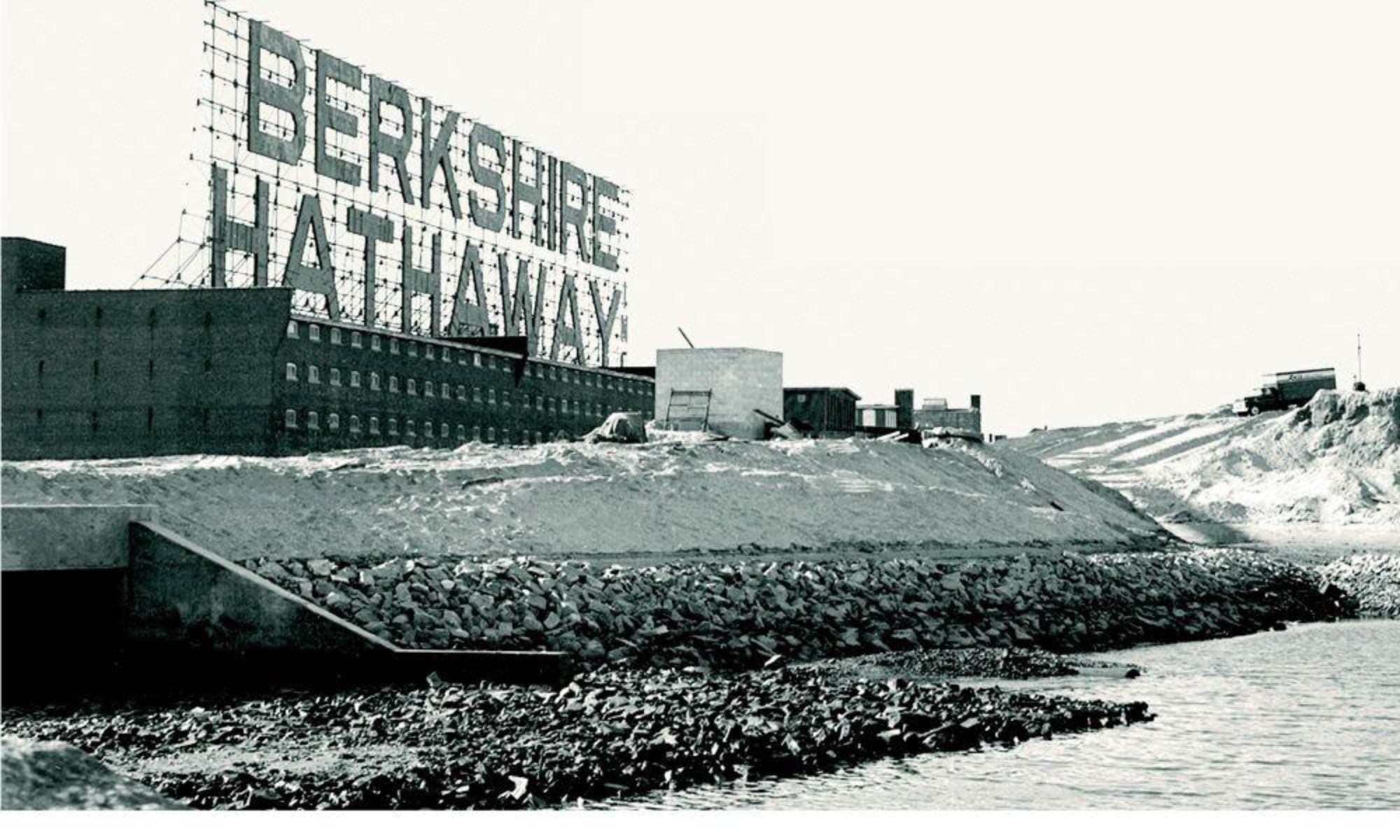

The kind of stocks I’m looking for are quality, low debt companies at attractive cash flow yields. I’d love to find a great brand or consumer defensive company at a good price. So far these stocks aren’t cheap enough for my liking. Statistically cheap deep value stocks are an alternative if I can not find companies that fit my criteria. And of course, I could always buy some Berkshire.

Alternatively, I may pivot to Ben Graham net-nets. Right now it is difficult to foresee what the human toll, let alone the economic damage of this pandemic. If the effects cause a deep, but V-shaped recovery, then it may be wise to buy quality companies at bargain prices. On the flip side, if it turns out the economy is being shut down for months, we could be looking at the worst economic conditions since the Great Depression. In this scenario I may want to shift my focus to buying companies below their liquidation value. This may provide the best margin of safety in these highly uncertain times.