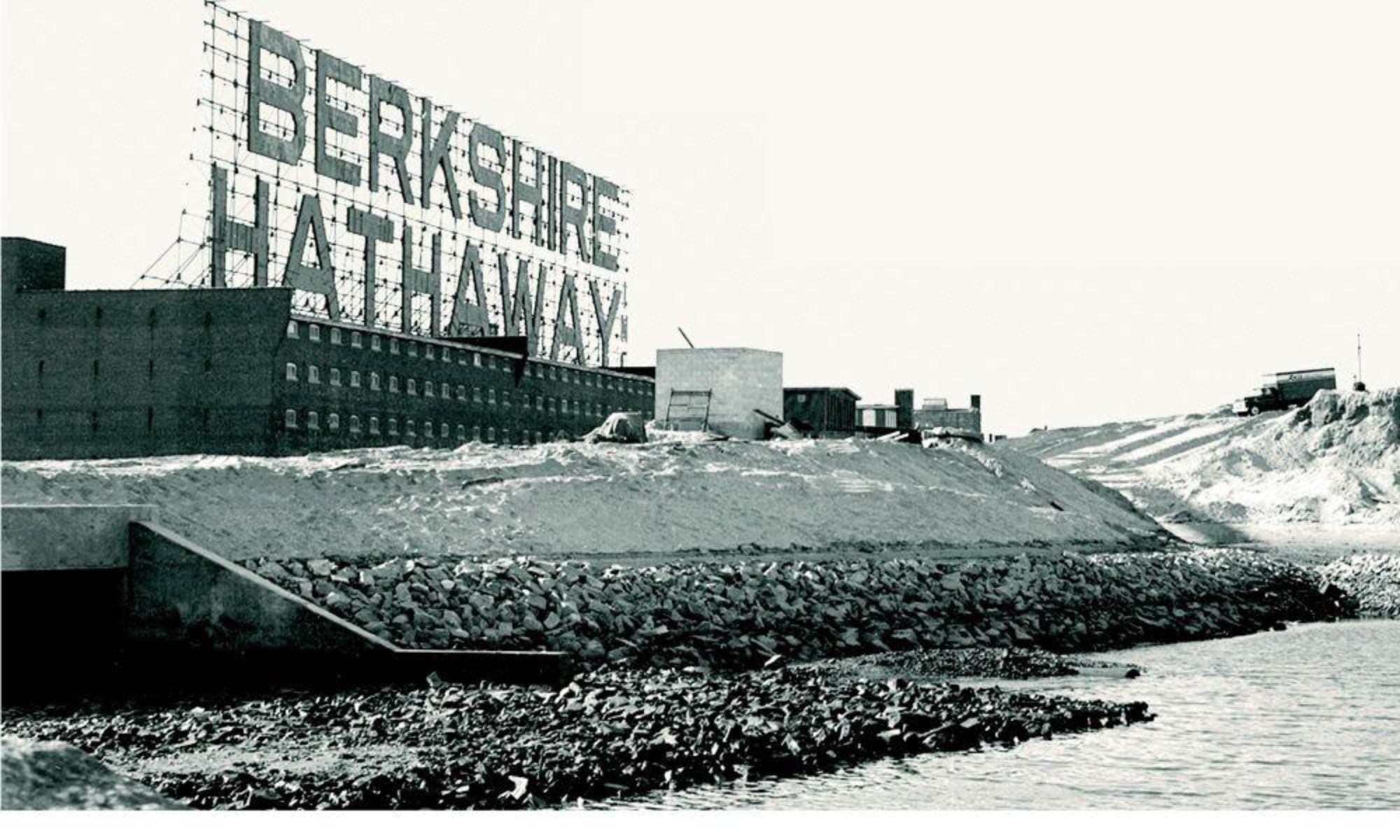

So far on this blog, I’ve written about my current stock positions and have casually mentioned that I use the value investing strategy. In this post I want to define what value investing means to me. Value investing was pioneered by Benjamin Graham, who was Warren Buffett’s professor and for a short period, boss. Buffett took value investing to new levels. He built the juggernaut of Berkshire Hathaway and teaching his investing philosophy along the way. Other well known value investors include Charlie Munger, Walter Schloss, Lou Simpson, Bill Miller, Peter Lynch, Bill Nygren.

Value investing is the process of buying an undervalued asset and selling it if it becomes overvalued. This sounds like the age old “buy low sell high” mantra, which is what everyone is trying to do right?

The difference is that for a company to be undervalued, you must know what is a fair value…what the business is worth. There are many ways to value a business, which I’ll save for a different post. All valuation techniques involve some analysis of the earning power and growth of those earnings. Value investors believe each business has some intrinsic value, or a reasonable valuation, based on its earnings power. The price that a stock trades at reflects to some degree the performance and economic environment of the business. However, a large degree of a stock price is based on psychology and other market forces. This means that a stock can trade at a discount to its intrinsic value if the market is pessimistic on the company’s outlook. On the other hand, a stock can trade at a premium if the market is overly rosy on the business.

How Does Value Investing Make Money

Investing in a company at its fair value can be a reasonable proposition. The real money is made by buying below intrinsic value, and waiting for the company to appreciate back to its fair price. It may sound silly that businesses trade at a discount, then revert back to a reasonable price, but opportunities like these exist. The goal is to buy $0.50 dollars and wait for them to go back to being a dollar. This sounds simple…but it is not easy.

The Philosophy

Value investing to me is more than just another strategy like growth, momentum, trend following, technical analysis, risk parity, etc. It is a philosophy. Most people think stocks are a piece of paper that gets traded bank and forth, numbers on a screen that go up and down, a spin of the roulette wheel, some get rich quick scheme, or some amazing story of how this company is going to be the next Microsoft.

I saw the light when I read Warren Buffett’s shareholder letters. In these letters he described stocks as owning a fractional share of a business. Owning stocks means you are a business owner. Therefore you should only be buying good businesses that you understand. Businesses sell things, pay employees and incur other costs, produce a profit, reinvest those profits back into the business to grow, pay out some profits to the business owners (stockholders). Value investing is estimating what this business is worth, and opportunistically buying it when the market does not agree with you.

A write up of my Q2 2020 results can be found here

Check out my summary of my March Stock purchases